The QBID is available to non-corporate taxpayers, including Individuals, Trusts, and Estates. The Sec. 199A deduction is available to non-corporate taxpayers who have qualified business income, which requires the income to be from qualified pass-through entities. Qualified pass-through entities include sole proprietorships, S corporations, partnerships, trusts, and estates. Qualifying business income 1) Is effectively connected […]

Continue readingAuthor Archive: niyatihemani

Standard and Itemized Deductions

Taxable Income = AGI – Itemized Deduction on Schedule A or the standard deduction – QBID Standard Deductions Persons who are not allowed Standard Deductions are: 1) Persons who itemize deductions 2) Nonresident alien individuals 3) Individuals who file a “short period” return 4) Married individuals who file a separate return and whose spouse itemizes […]

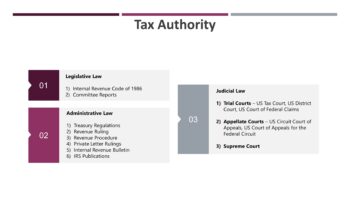

Continue readingTax Authority

3 Sources of Authoritative Federal Tax Law are: Legislative law Administrative law Judicial law Legislative Law Legislative law, which comes from Congress is authorized by the constitution and consists of the Internal Revenue Code and Committee Reports. The Internal Revenue Code of 1986 is the primary source of Federal Tax Law. It imposes income, estate, […]

Continue readingTax Position

A taxpayer’s accuracy-related penalty due to disregard of rules and regulations, or substantial understatement of income tax, may be avoided if the return position is adequately disclosed and has a reasonable basis. Generally, the penalty is equal to 20% of the underpayment. Substantial understatement of income tax occurs when the understatement is more than the […]

Continue readingDue Dates For Filing Income Tax Return

Original and Extended Due Dates of filing of return of income for a calendar year tax payer Return Type Original Due Date Extended Due Date S corporation March 15 September 15 Partnership March 15 September 15 Estate and trust April 15 September 30 Individual April 15 October 15 Exempt organization May 15 November 15 A […]

Continue readingForeign Tax Credit

A deduction is allowed for foreign income taxes paid or accrued during the taxable year. Alternatively, both individual taxpayers and corporations may claim a Foreign Tax Credit on income earned and subject to tax in a foreign country or U.S. possession. One may not claim both the deduction and the credit. The Foreign Tax […]

Continue readingEstimated Taxes

Each quarterly estimated tax payment required is 25% of the lesser of 100% of the prior year’s tax, provided the tax liability existed and preceding tax year was 12 months (not for corporations with taxable income ≥ $1 million), 100% of the current year’s tax, or 100% of the annualized income (for corporations with […]

Continue readingPERSONAL HOLDING COMPANY (PHC) TAX

The PHC tax is a 20% penalty tax imposed on the undistributed income of a corporation that meets the following two tests. Stock ownership test More than 50% by value is owned by 5 or fewer shareholders at any time during the last half of the year. Nature of income test 60% or more of […]

Continue readingACCUMULATED EARNINGS TAX

The accumulated earnings tax (AET) is imposed only on a corporation that, for the purpose of avoiding income tax at the shareholder level, allows earnings and profits to accumulate instead of being distributed. The accumulated earnings tax is imposed by Sec. 531 on unreasonably large accumulations of earnings in a corporation.. Without showing a […]

Continue readingBusiness Nexus for Sales Tax

For a taxing authorities to tax sales and income-generating activities, nexus is required to be established of a physical and/or financial presence within a jurisdiction. Here are the 5 drivers in establishing the nexus … A physical location in the state Resident employees working in the state Real or intangible property (owned or rented) within […]

Continue reading